-

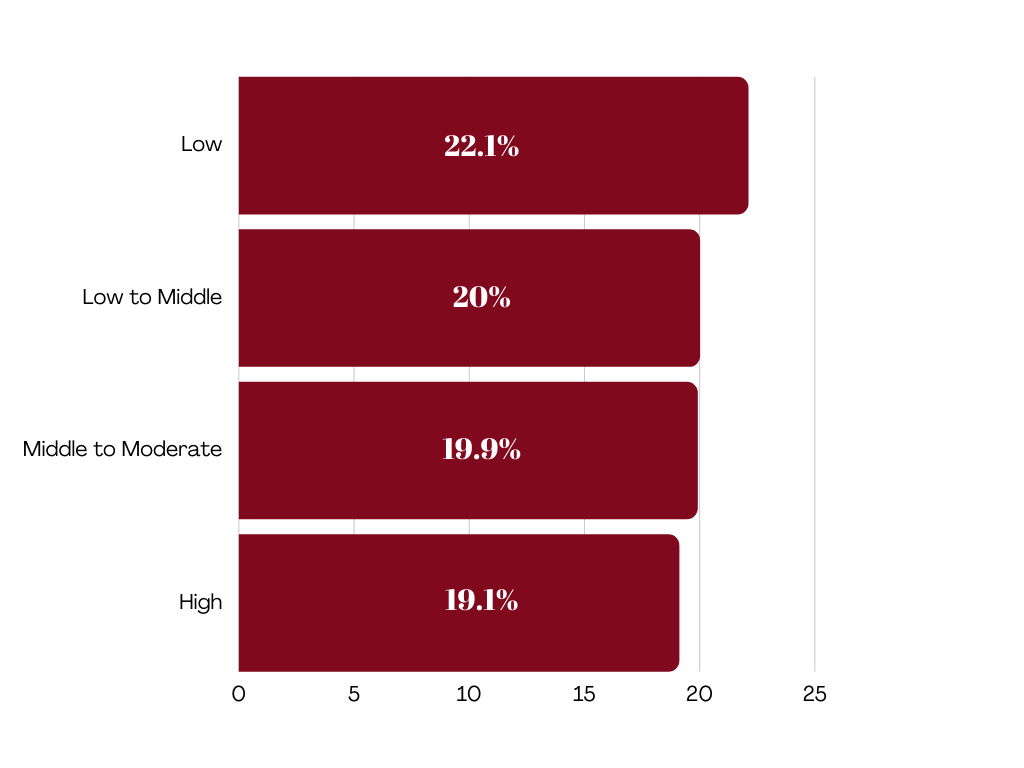

In the past year, one of the biggest themes was how well the residential real estate market did. Home price appreciation is one crucial statistic that has received a lot of attention recently. Home prices are rising this year, according to the most recent indexes. The following are the most recent p

Read More -

Things you should know before buying a house

Things you should know before buying a house. Are you tired of renting and following the agreed terms from a landlord? Considering to be a fur parent but your landlord is not amiable to it? Or - do you feel the excitement of owning a new house? Buying a house isn’t as simple as someone might think

Read More

Categories